Calculation of the R&D tax benefit for those applicants with a turnover greater than $20 million from 2021/22 income year:

The ATO defines “Total Company Expenditure” to be the expenses included as part of item 6 of the applicant’s tax return.

The R&D intensity is the calculated as the R&D expenditure as a proportion of total expenditure for the year, the rates are the applicants company tax rate plus:

- 8.5% for R&D expenditure up to 2% R&D intensity

- 16.5% for R&D expenditure above 2% R&D intensity

Example:

DEF Limited has a turnover of $100 million. Its company tax rate is 30%.

For the year ended 30 June 2022 its R&D expenditure is calculated to be $8 million.

Total company expenditure, as per Item 6 on the company tax return is $88 million.

Expenses include cost of sales, superannuation, bad debts, rent, interest expenses within Australia, depreciation, motor vehicle expenses, repairs and maintenance, all other expenses.

DEF’s R&D intensity is therefore 9.09%.

Its R&D tax benefit is calculated:

- 2% of $88,000,000 = $1,760,000 @ 8.5% or $149,600

- 16.5% of $6,240,000 = $1,029,600

Total R&D tax benefit is $1,179,200

This compares to the R&D tax benefit received under the previous system of $680,000.

R&D changes for the 2021/22 year

The government announced changes to the Research & Development Tax Incentive (RDTI) in the 2020/21 budget. These changes will apply from the first income year commencing on or after 1st July 2021.

For most applicants this will be applicable from the 2021/22 applications.

The changes include;

- For companies with an aggregated turnover of $20 million or more, the Government will introduce a two-tiered premium that ties the rates of the non-refundable R&D tax offset to the incremental intensity of the R&D expenditure as a proportion of total expenditure for the year. The new rates will be the claimant's company tax rate plus:

- 8.5 percentage points for R&D expenditure up to 2 per cent R&D intensity

- 16.5 percentage points for R&D expenditure above 2 per cent R&D intensity

- For companies with an aggregated turnover below $20 million, the refundable R&D tax offset will be a premium of 18.5 percentage points above the claimant's company tax rate.

- Increase the R&D expenditure threshold from $100 million to $150 million per annum.

- Additionally:

- improving the transparency of the program by publicly disclosing R&D claims

- greater enforcement activity and improved program guidance to participants

- amendments to technical provisions.

Please note that the closing date for R&D applications is Tuesday 3rd May 2022. The usual deadline of 30th April has been extended to the next business day for all States & Territories.

EMDG update for 2021/22

Austrade have announced the payments schedule and anticipated amounts under the “new” EMDG program.

In summary the new EMDG scheme had more 5,300 applications. Unfortunately, funding has remained at the same level as the “old” reimbursement scheme.

The advice from Austrade is:

"Given the EMDG program funding is a set allocation per financial year and must be spread across all applications, grant amounts per business are likely to be smaller than in previous years due to the higher number of applications.

All eligible applicants will be offered a grant agreement with the available funding to be allocated amongst all eligible applicants.

Estimated grant amounts

The final grant amounts will be calculated after all applications have been assessed.

Given the level of demand and funding, we estimate applicants could expect to receive up to the following grant amounts in these tiers:

- Tier 1 - $15,000 per financial year

- Tier 2 - $23,000 per financial year

- Tier 3 - $35,000 per financial year

Representative bodies could receive up to $90,000 per financial year as there were fewer applications in this tier.

Note: Tier 3 applicants will only receive a Tier 3 agreement if they have demonstrated eligibility for a Tier 3 grant. Applicants who have not provided sufficient information will be offered the option of a Tier 2 grant agreement. This note is important due to the high number of applicants who applied in Tier 3 – including many who have never previously applied to EMDG."

Tier 3 applicants have to demonstrate to Austrade that they are making a strategic shift. This is defined as targeting a new market or a new type of customer. Austrade appear to be rigoursly applying this policy to Tier 3 applicants.

The proposed EMDG payments certainly reduce the benefits of the scheme given the amount of work applicants must undertake to both qualify for the grant and conduct their overseas marketing activities in these difficult pandemic times.

EMDG has become an underfunded bureaucratic nightmare

R&D TAx incentive changes 2020/21

The 2020/21 Ausindustry application has undergone some changes. No longer will record keeping be sectioned out into “Objectives”, “New Knowledge”, Core Activities” and “Supporting Activities” on a PDF document.

I am required to login via a portal (which won’t be operation till July) and information is entered into sections.

I have added in screen shots of what Ausindustry is asking of applicants this year.

I have reflected these changes into the “RJED Monthly Format”, which all clients will be receiving a copy of for the 2020/21 application year.

The new questions are;

- Core Activity – 4000 characters or less

- What is the Hypothesis? 50-4000 characters

- What was the experiment and how did it test the hypothesis? 50-4000 characters

- How did you evaluate or plan to evaluate results from your experiment? 50-4000 characters

- If you reached conclusions from your experiments in the selected income period, describe those conclusions. 50-4000 characters.

As this portal is in a test phase till 18th June

R&D Tax Incentive Customer Portal Login

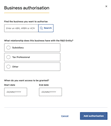

Login process is as follows;

To login with myGov you must use the company log in

From there you will taken to the landing page. (fig 2)

- Here is where you can start the process of your registration from for the selected income year. (Fig 2 red circle)

- “The applicant” needs to give RJED Consulting access to the application form to do this, you must click on “Manage Access” (red arrow)

- Click “Add new authorisation”

- As per fig 4, you will need to enter the ABN number for RJED Consulting Pty Ltd -:

- 77144506525

- Tax Professional

- 01/06/2021 – 30/06/2022

- Add authorisation

- Advise RJED Consulting that access to the application form is available.

- Comment: this is the new system and there will be teething problems until we all get used to this system.

EMDG Update

The Minister for Trade has announced that there will be no second tranche payment for the 2019/20 EMDG claims. This means that a maximum grant of $100,000 will apply for the 2019/20 EMDG claims.

Austrade have announced that the export performance test will apply for the 2020/21 EMDG claims. The first tranche payment for 2020/21 will be a low $30,000. It appears Austrade and the Federal Government are anticipating a large number of claims for the 2020/21 claim year.

The 2020/21 grant year will be the final year for EMDG under the current legislation. Austrade is moving to a pre-approval basis for the EMDG scheme. Guidelines have been announced and comments have been invited.

Budget Changes To The R&D Tax Incentive

The current R&D Tax Incentive (RDTI) Bill, that sought to introduce $1.8 billion in cuts over 4 years from 2019/20 onwards, has been abandoned. This means that the current RDTI regime applies for the 2019/20 and the current financial years.

For small claimants (turnover less than $20 million), the Government will increase the refundable R&D tax offset to 18.5 percentage points above the claimant’s company tax rate, and there will be no $4 million cap on annual cash refunds.

For larger claimants, the Government will streamline the intensity test from three to two tiers and increase the non-refundable R&D tax offset rates. The new rates will be the claimant’s company tax rate plus 8.5 percentage points for initial R&D expenditure up to 2 per cent R&D intensity, and 16.5 percentage points for R&D expenditure above 2 per cent R&D intensity.

The R&D intensity test will link the tax off-set to the intensity of the applicant’s R&D expenditure compared with its total expenditure.

The Government will also proceed with the increase in the cap on eligible R&D expenditure from $100 million to $150 million per annum.

Company tax rates for companies with a turnover less than $50 million (base rate entity) are:

| Year | Company tax rate % |

|---|---|

| 2019/20 | 27.5 |

| 2020/21 | 26 |

| 2021/22 onward | 25 |

For non-base rate entities, the company tax rate is 30%.

These changes apply from 1 July 2021 and will support more than 11,400 companies that claim the R&DTI.

Larger claimants (annual turnover 0f $20 million or more)

- Streamlined two tiered intensity test

- Non-refundable tax offset of the company tax rate plus:

- 8.5% for R&D expenditure between 0 and 2% R&D intensity; and

- 16.5% for R&D expenditure above 2% R&D intensity

Job Keeper and The R&D Tax Incentive

This is to advise all R&D applicants of the draft TD2020/D1. That is “notional deductions for research and development activities subsidised by Jobkeeper payments”.

The ATO has released a draft Determination that applies to JobKeeper payments received by an R&D entity.

This ruling will mean that if an entity receives a JobKeeper payment for an eligible employee who is engaged in R&D activities during a fortnight, that entity cannot notionally deduct so much of the wage paid to that employee as is equal to the $1500 JobKeeper payment.

The ruling further states that if the entity receives a JobKeeper payment for an employee who is partially engaged in R&D activities during a fortnight, the notional deduction is partially reduced. That is, it is reduced by that portion of the JobKeeper payment as is in proportion with the time the employee spends on R&D activities during that fortnight.

It is proposed the date of effect of the final Determination will apply both before and after its date of issue.

In other words, JobKeeper payment is deemed by the ATO as expenditure “not at risk”. If an employee is paid $2000 per fortnight and works full-time on R&D activities and the R&D entity receives $1500 JobKeeper payment, it can claim $500 for that employee for the fortnight’s R&D activity.

Covid-19 and EMDG 2019/20 Grant Year

Today the Morrison Government added an extra $49.8 million into the EMDG program for the 2019/20 financial year.

Austrade has advised that applications lodged in the 2019/20 financial year, the payout figure for the second tranche will be 100%.

|

Can you claim promotional expenses impacted by COVID-19? |

|

Have you incurred EMDG-eligible expenses for promotional activities in 2019–20 and 2020–21? If these activities have now been impacted by COVID-19 (such as trade show cancellations), Austrade will treat these activities as having taken place. Therefore, any incurred expenses will be eligible for EMDG reimbursement in 2019–20 and 2020–21. The Government has also waived the export performance test for companies applying for the 2019/20 grant year from July 1st 2020. Any business which has incurred eligible EMDG expenses for promotional activities in 2019–20 will be able to seek reimbursement for 50% of these expenses without the Export Performance Test applying.

For more information click the link below for more information |

COVID-19 and the R&D Tax incentive

Today The Department of Industry, Science, Energy and Resources sent all Tax Agents an email regarding the effects of COVID-19 on Australian businesses.

If you are applying for the 2018/19 R&D Tax Incentive, businesses now have until 30th September 2020 to get their applications in, without applying for an extension. If you are still unable to meet the September 30 deadline, you may request a time extension.

Companies will still have to provide your R&D Tax Incentive registration number when you lodge the 2018/19 company tax return.

With social distancing the new norm, Bob and the team are still contactable and are happy to conduct meetings via; FaceTime, Skype or any other online meeting platform.

For more information click the link below for more information.

https://mailchi.mp/industry/rd-tax-incentive-e-bulletin-special-covid19?e=22662ac0c0

2018/19 R&D Submissions

Ausindustry registrations for the 2018/19 R&D tax incentive can lodged from 1st July 2019. The year just concluded saw a large number of clients not prepared to submit their 2017/18 registration until late April 2019. This has an impact of delaying processing by Ausindustry, as they receive a large number of registrations in the month of April. Added to this workload was Easter and Anzac Day holidays.

We urge you to have the R&D information, updated R&D projects and 2018/19 P&L ready for us to proper the 2018/19 Ausindustry registration form before the end of October 2019. This will ensure smooth processing of the 2018/19 company tax return and in some cases meet external parties requirements for this information.

We also would like to remind all applicants, that Ausindustry will not accept R&D project descriptions that describe the R&D conducted “as being the same as last year”. This comment will be rejected by Ausindustry.

To get started on the 2018/19 year please contact us at info@rjedconsulting.com.au

R&D Tax offset rates from 2016/17 income year

The Research and Development tax incentive rates from the 2016/17 income year are:

For applicant companies with a turnover less than $10 million R&D fully refundable tax offset rate 43.5%, company tax rate of 27.5%.

Turnover between $10 million and $20 million R&D fully refundable tax offset rate 43.5%, company tax rate 30%.

Turnover greater than $20 million, R&D non-refundable tax offset 38.5%, company tax rate 30%.

Company tax rates:

| Income year | Turnover threshold | Company tax rate for entities under the threshold | Company tax rate for entities over the threshold |

|---|---|---|---|

| 2015/16 | $2m | 28.5% | 30.0% |

| 2016/17 | $10m | 27.5% | 30.0% |

| 2017/18 | $25m | 27.5% | 30.0% |

|

2018/19 to 2023/24 |

$50m | 27.5% | 30.0% |

| 2024/25 | $50m | 27.0% | 30.0% |

| 2025/26 | $50m | 26.0% | 30.0% |

| 2026/27 | $50m | 25.0% | 30.0% |

(sourced from ATO)

Ausindustry registration update

Applicants need to be aware of the specific information that should be included in the critical areas of the registration form. These areas are:

- New knowledge: The need to explain how this is different from knowledge that is already available in the public arena and reasonably accessible on a world-wide basis. This description should also refer to the specific information sought to be generated to resolve the technical areas of uncertainty identified in the core R&D activities;

- Outcome: A description why the outcomes of the hypothesis the company is testing, and not the outcome of the overall project, cannot be known or determined in advance;

- Core R&D activities: The descriptions should include the experiments undertaken and include the hypothesis of the experiments and a description of the experiments.

- Supporting activities: These must be directly related to a core R&D activity. Therefore the supporting activities must be directly related to the design, set up or conduct of the experiment, the observation and evaluation of the experiment, or drawing of logical conclusions about the experiment.

What this means. The comments should be more than "developing an application that has not been created or marketed before in the world". This statement will not be accepted as it doesn't address the information required. Maintaining a written report on a regular basis that identifies the technical risks and uncertainty associated with the R&D activities is essential. Together with any supporting documents, reports, drawings, photos, third party evidence, emails etc will greatly assist the preparation of the Ausindustry registration and any review of the R&D activities.